Your Dedicated And Detail-Oriented Tax Specialist In St. Albert

Get the right advice for your situation with expert solutions for all your tax requirements. We make the process stress-free and convenient so you can approach the tax season with confidence.

We provide tax preparation/advisory, non-filed tax returns, CRA Audits, and Bookkeeping services for people and businesses across St Albert and the surrounding areas.

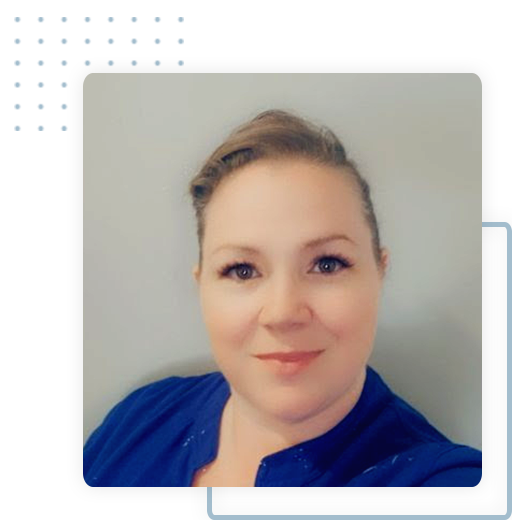

About

Laura Jackson

Hello,

I would like to introduce myself and hope that this digital introduction is reason to contact me personally. My name is Laura Jackson and I have been in customer service for over 25 years and more than 10 years as a dedicated and conscientious tax professional. In this job I understand the importance of privacy and clear communication as well as maintaining strong relationships.

Principal Residence!

From 2016 Onward

Sold? Moved out? Converted to rental?

Foreclosure? Executors: Deceased on the title?

New Rules in place!

You are now required to report the disposition – does not mean just the sale – of any real property including your principal residence on your income tax return…

For instance, if you decided to retire and sell your home and move out to your lake home, there are two items to report: One – the sale of your primary residence and two, the Capital Gain on the lake home. If you’re not sure, please call us.

CRA can impose a $100 per month penalty for failure to report which they will allow to accumulate to $8000!

If you did not report your disposition of any property in the previous years, please contact our office today.